How Much Should I Invest in Cryptocurrency as a Beginner?

Over the past few years, the unstable economy has caused many people to become uncomfortable with the thought of continuing to invest their funds in assets that are tied to the U.S. dollar, the government, or Wall Street. These intelligent people have come to the conclusion that investing in cryptocurrency is a more financially sound option, and worth looking into. With that awareness comes the question, “How much should I invest in cryptocurrency as a beginner?” For anyone asking this question, you’re off to a good start in your investing journey. Why? Because it’s always best to do your due diligence instead of just blindly investing your hard-earned money.

So, let’s dive in and answer this question so you can make a more informed decision on the right amount of money to invest in Bitcoin and various altcoins when you’re just starting out.

1. Only Invest What You Can Afford to Lose

Only investing what you can afford to lose might seem like a simple answer, but it’s really the most important element in determining how much you should invest in cryptocurrency when you’re new to the game. You may be thinking, “You can’t invest what you can’t afford, right?”. Well, some people do and end up losing their entire savings, their home, and more because of it. This may sound a bit extreme, but it’s happened to more than a few investors who got caught up in the excitement of buying and selling crypto.

Plus, keep in mind that you’re getting into this to make a profit, so having a smart strategy can really maximize your chances of profiting. With that said, only investing what you can afford should be the foundation of your plan. So, how do you determine what you can afford to lose? Let’s find out:

Figure Out What’s Needed to Cover Your Expenses

First things first, you have to ensure all your expenses are taken care of – mortgage or rent, car payment, health insurance, utilities, fuel, groceries, entertainment, as well as allocating money towards an emergency fund. To be on the safe side, after you’ve come up with your final number, add an additional 10% on top of it as a cushion. Now, subtract the total number from your monthly income. So, let’s say you make $4,000 a month after taxes, and your expenses with 10% padding come to $3,000; this leaves you with $1,000.

How Much Money is Left to Invest in Cryptocurrency?

Technically, with all your expenses covered and emergency funds being tucked away, it would appear that you have $1,000 a month left over to invest in crypto. However, this number is really just your starting point. In reality, this is a large sum of money that you’ll want to be careful with as a cryptocurrency investor who is just beginning their journey, and so the full amount remaining really should not be invested. This brings us to the next point – investing a percentage of your money.

2. Beginners Should Invest a Small Percentage of Their Available Funds and Grow from There

As mentioned, just because you have a certain amount of money left over after your expenses, it’s not a good idea to invest that entire amount each month. Instead, you should invest a percentage of it, a small percentage. Why is this the case? Because when you’re an inexperienced crypto investor, you’re going to make mistakes; we all do when we begin investing. I know I certainly did. Couple this with the fact that the crypto market can sometimes be volatile, and you can risk losing a lot of money if you’re not careful and conservative.

To be conservative, you may only want to start with investing 5% of your available funds for the first few months or longer, which according to my example, would be $50 each month. This will give you some money to play with, as well as time to learn the ropes without risking losing a big chunk of your money. Then, once you start understanding how to invest intelligently, and learn some tricks of the trade, you can up your game a bit and invest a little more.

Ways to Speed Up the Investment Learning Process So You Can Safely Invest More Money

Once new investors get a taste of buying and selling cryptocurrency, it’s common to want to jump ahead and start investing more. Believe me, you don’t want to get ahead of yourself when you’re not ready. Besides the possibility of losing money, it can be a real discouragement when you do. So, for those who want to safely speed up the learning process, I have a few recommendations for you:

All Beginners Should Practice on a Crypto Trading Simulator

One of the best things you can do to jumpstart the learning process is to utilize a trading simulator, often called a paper trading account. Check out Webull, as well as TradingView; they both offer practice accounts that will allow you to learn how to invest and test your strategies in a trading environment, all with fake funds.

Dive into Technical Analysis to Up Your Trading Skills

It’s important to know that it’s possible to predict future trends and actually know where a digital coin is heading when you study its price patterns. The fact is that history repeats itself, so much so that there are technical indicators to watch out for when charting Bitcoin and altcoins. Technical charts can reveal when certain cryptocurrencies are going to take a dive or soar. This gives you a heads up on when to buy, when to take profits, where to set stop losses, and when to reinvest.

TradingView provides up-to-date charts that you can use to make data-driven decisions instead of just blindly investing. Also, I highly recommend heading over to Amazon and investing in this book – Technical Analysis for Dummies. I owe a majority of my technical analysis skills to this awesome book.

Subscribe to Reliable Crypto Channels

It’s essential to research and keep growing your knowledge base so you can work your way up from a beginner to a seasoned investor, which will allow you to invest more money, and invest it wisely. For this reason, I love helping others learn to invest and grow, and I’ve created a few channels for those who are interested:

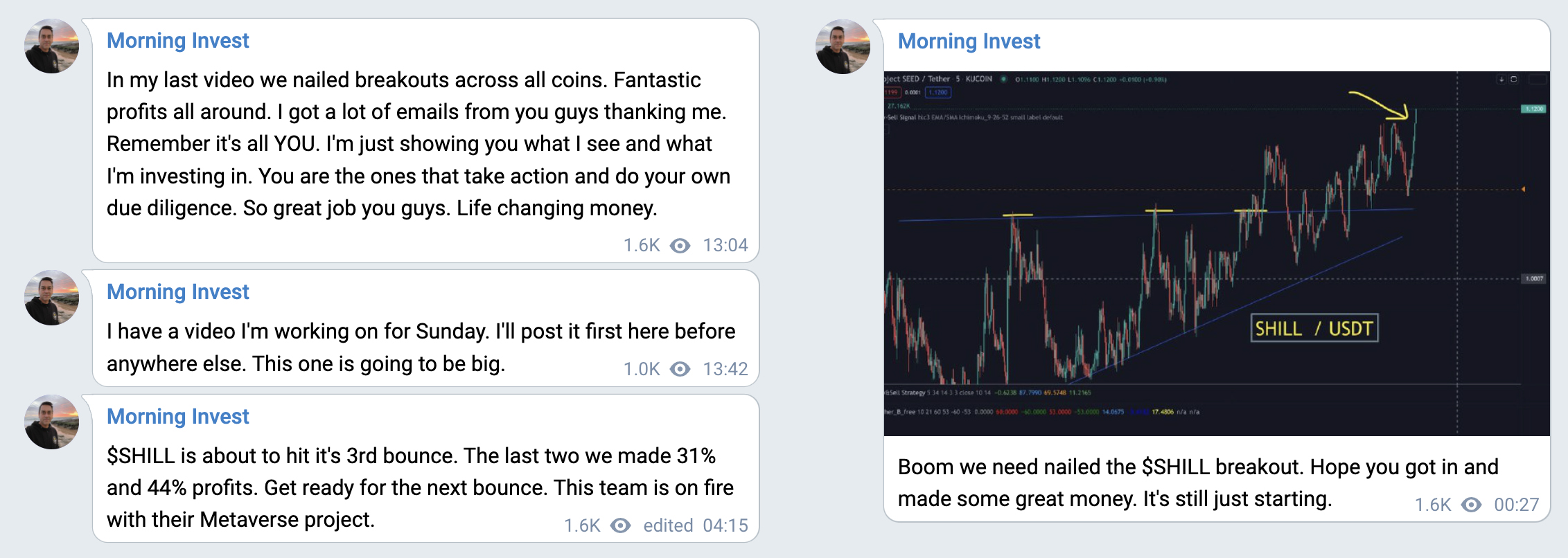

Telegram Channel

My Telegram channel is where I post information about the trades I’m making, and other related information. I include up-to-date trading details for those who want to learn more by watching what I’m doing. For example, I discuss what I’m personally watching in the market, upload trading chart snapshots that display patterns to watch out for, as well as post data on what I’m about to invest in based on my technical analysis, and so on. You can follow me for free on my Telegram channel. For those who are new to Telegram, I’ve included a few snapshots below of what I typically post to give you an idea of what you can expect:

Crypto News Daily YouTube Channel

For those who want to fast-track from beginner to experienced crypto investor, I suggest you check out my channel Crypto News Daily. I’ve dedicated this channel to teaching individuals how to build wealth by investing in cryptocurrency and other performing assets. I cover my top picks, discuss technical analysis, post industry professional interviews, what’s going on with Bitcoin and various altcoins, the Metaverse, Web 3.0, and a lot more.

Here’s a Crypto News Daily video that you can dive into:

After playing around on a trading simulator where you’re coming out on top more than losing, and after you’ve reeled in as much knowledge as you can from reliable sources, you can then consider investing a larger percentage of your money. The amount you invest should really be a number that you feel comfortable with, and it should be a responsible amount for the trading level you’re at. Each time you feel you’ve reached a milestone in gaining a significant amount of experience, you’ll feel more comfortable investing a larger percentage.

3. Don’t Invest All Your Funds into One Crypto Basket – Diversify

If you’re truly a beginner when it comes to investing, you may not have a good understanding of diversification. The diversification factor is important in determining how much you should invest in cryptocurrency when just starting out. Diversification simply means to invest in a few different asset types, or even several various assets within one class, and not put all your eggs in one basket. This could protect you financially if the one asset you invest in were to crumble.

Some diversify by investing in crypto and the stock market, but for me, I mostly diversify by investing my funds in both crypto and rental real estate. My point is, don’t invest all your funds into cryptocurrency, especially as a beginner – it’s not a smart strategy.

While we’re on the topic of real estate, you will most likely find this forward-thinking article interesting – How Real Estate Purchases are Being Transformed by the Benefits of Blockchain Technology.

Let’s Summarize How Much You Should Invest in Crypto as a Beginner

Let’s do a recap and pull all this information together so you have a better idea of how much money you should invest as a newbie. First, it’s worth noting that everyone has their own set of financials, their own situations that are unique to them, and so there is really no cookie-cutter answer to how much you should invest. However, if you follow some guidelines and expert tips from those who have made it past the beginning stages of their investing careers, then you’ll have a better understanding of how much of your funds you should allocate towards Bitcoin, top altcoins, and small-cap coins. Here’s a brief summary of what we discussed using the numbers we have been working within our example:

- Determine your monthly expenses and pad that by adding an additional 10% on top of that to be conservative: (Expenses + 10% = $3,000)

- Subtract this number from your monthly income: (Monthly Income $4,000 – Expenses $3,000 = Available Funds of $1,000) For those who are interested, don’t forget to factor in allocating some of your funds to alternative investments such as rental real estate, gold, or carefully chosen stocks.

- Take a percentage of the remaining amount of $1,000, preferably only 5%, which is $50 per month, and use that to trade for a few months, or as long as it takes. Only invest 5% if you’re comfortable losing that percentage in the process because it may happen – you can always invest a smaller percentage.

- While getting your feet wet with $50 per month, also use a trading simulator and invest with a larger amount of fake money. This is an incredible resource for gaining real experience without the risk of losing any money. Please note that if you have zero experience with no knowledge of crypto whatsoever, you may want to do step 3 after you have some wins on a trading simulator. I placed starting with real money alongside utilizing a trading simulator because most people can’t wait and want to at least start investing a small amount right away.

- After gaining a significant amount of experience, up the percentage of funds that you invest in crypto – maybe raising it to 10% of your available monthly funds, which would be $100 per month according to my example, and then raise it a bit more when you become even more experienced if investing heavily in crypto is your plan. Again, it all really depends on what percentage you’re comfortable with.

Start Your Crypto Journey Off with a Smart Investing Strategy

I hope this article has provided you with some insight as to how much money you should start investing with as you dive into the world of cryptocurrencies. The main point I really wanted to drive home in this post was that you should start small so you’re investing wisely and conservatively while learning and growing. It makes for a smart investing strategy right from the beginning, one that will protect your funds, and help you make intelligent investment decisions along the way.

Let’s end this discussion with a video from Crypto News Daily that I think you’ll find interesting: